Before You Retire

- Get ride of your debt.

- Don't enter into a car loan before entering into retirement. Pay cash for cars.

- Evaluate your insurance. Maybe you don't your life insurance, etc.

- Determine how you are going to pay for healthcare. Most Canadians pay these extra expenses out of pocket.

- Update your estate plan (will, power of attorney, document your digital assets(logins, etc).

- Determine your retirement age. (Will need to line up with your retirement plan!)

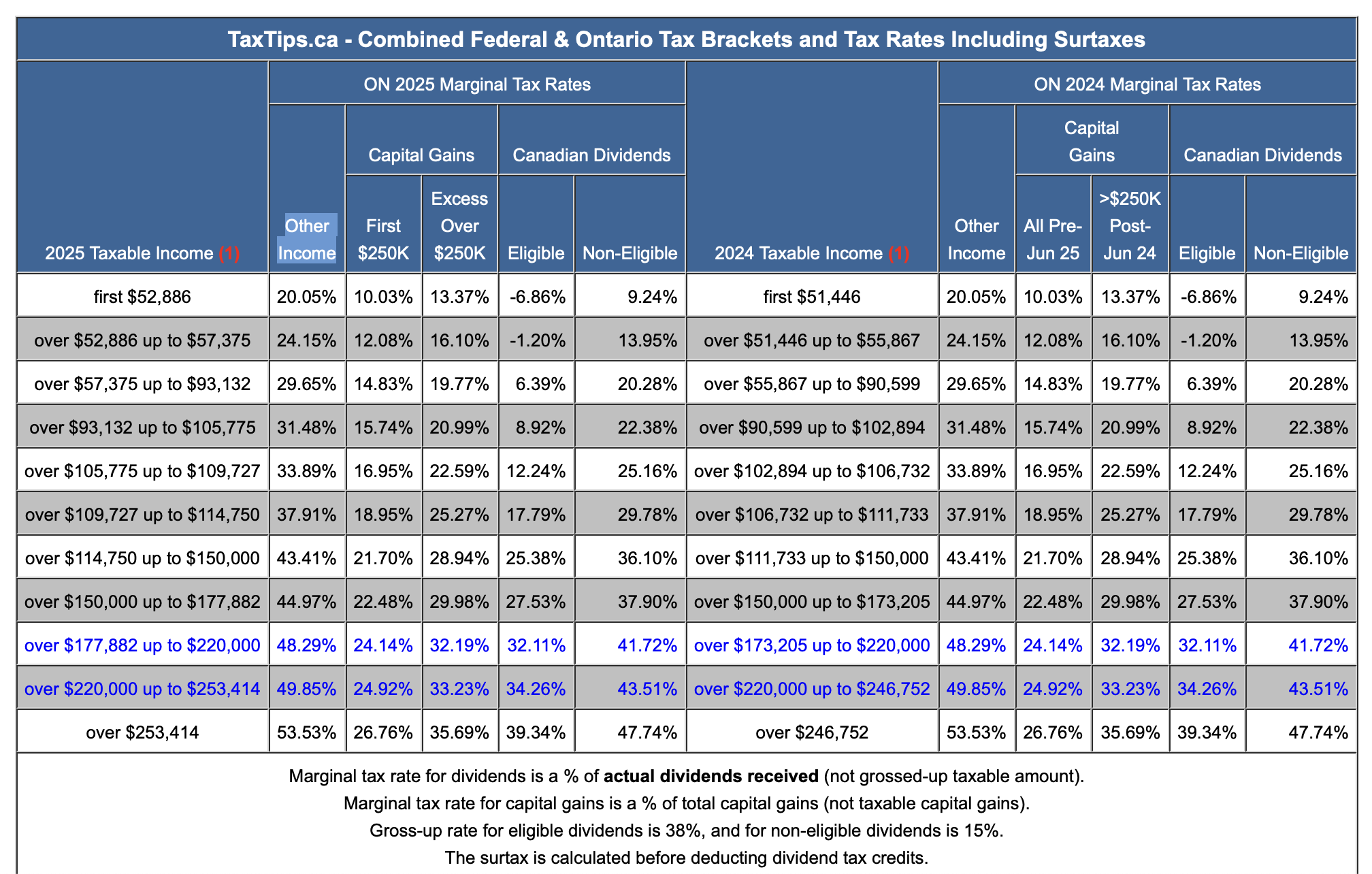

Tax Rates

https://www.taxtips.ca/taxrates/on.htm

In Ontario, the portion of your income that is not taxed comes from the basic personal amount (BPA), which applies at both the federal and provincial levels.

For 2025, the basic personal amounts are:

- Federal BPA: $15,000 (gradually reduced for incomes over $173,205)

- Ontario BPA: $11,865

This means that the first $15,000 of your income is not subject to federal tax, and the first $11,865 is not subject to Ontario provincial tax.

If you made $50k, you would pay tax on 50k-15k=35K at a rate of 20% = 7k

Retirement Budget

Figure out how much you need monthly once you retired.

Having money in a TFSA will help if you have a big expense, bucket list item, etc... since they don't count as income.

Income Base on Savings

Assumptions:

- Retiring at 60

- CPP at age 70, 75% of max

- Running estate to $0 until

- From age 60 to 95

| Total Savings | 500k | 750k | 1 mil |

|---|---|---|---|

| RRSP Savings | 400k | 550k | 800k |

| TFSA Savings | 100k | 200k | 200k |

Couple Yearly Income After Tax (Adjusted for Inflation) | $57,365 | $66,480 | $74,757 |

Single Yearly Income After Tax (Adjusted for Inflation) | $37,376 | $45,290 | $53,042 |

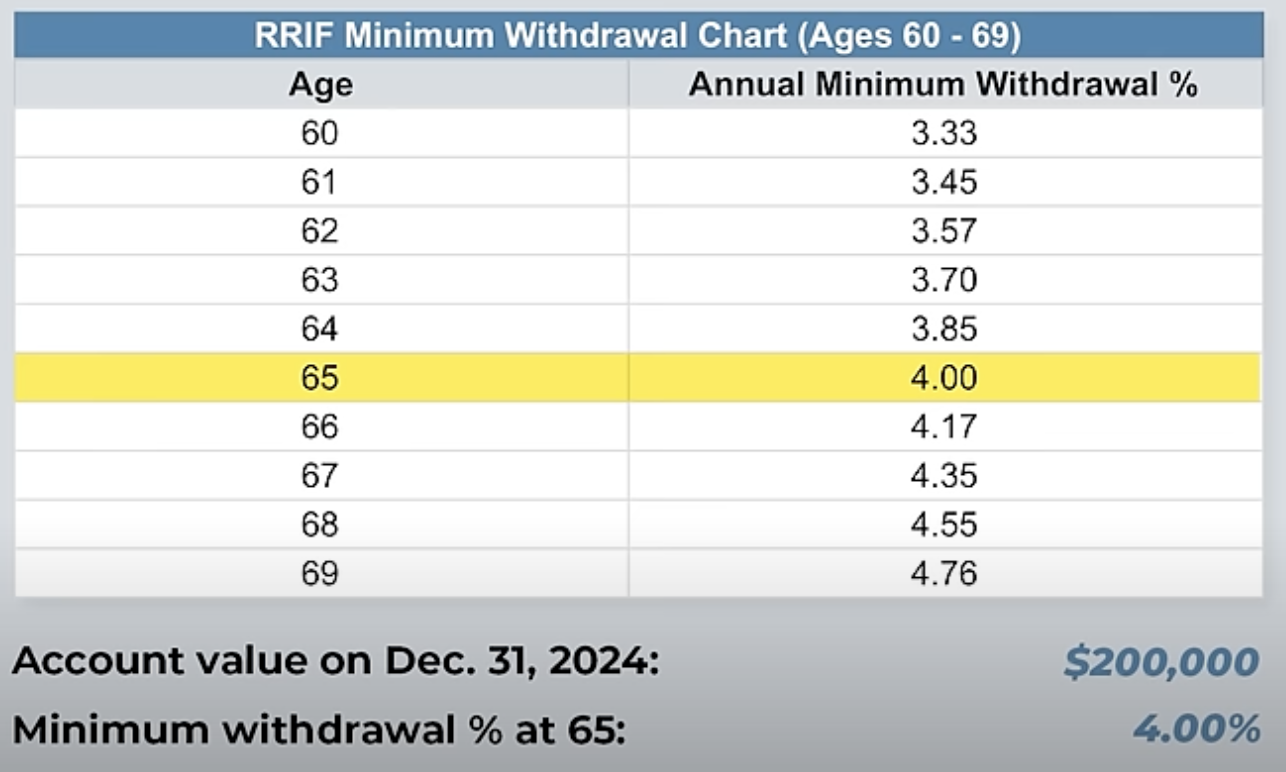

RRIF

Earnings in a RRIF are tax-free and amounts paid out of a RRIF are taxable on receipt.

When you retire, your RRSP needs to be converted to a RRIF before the age of 71.

At 71, you will be forced to convert your RRSP to a RRIF.

At 72, you need to start withdrawing from it.

There is a minimum amount that you need to withdraw once converted to a RRIF.

It is very unlikely that you would ever just take out the minimum.

Benefits of a RRIF over RRSP

- no commissions on withdrawal

- income splitting if 65 or older

- no withholding tax on the minimum, there is a withholding tax above the minimum.

Withholding Rates

- 10% on amounts up to $5,000

- 20% on amounts over to $5,000

- 30% on amounts up to $15,000

RRSP Meltdown Strategy

The RRSP Meltdown Strategy is an aggressive drawdown of your RRSP(RRIF) early in retirement.

- Drawing down your RRSP will allow you to delay your CPP/OAC.

- Money left in your RRSP(RRIF) upon your death will be taxed as if it was income received in that one year.

- You can use your TFSA for emergencies while pulling an income from your RRSP(RRIF). ie. new roof, etc...

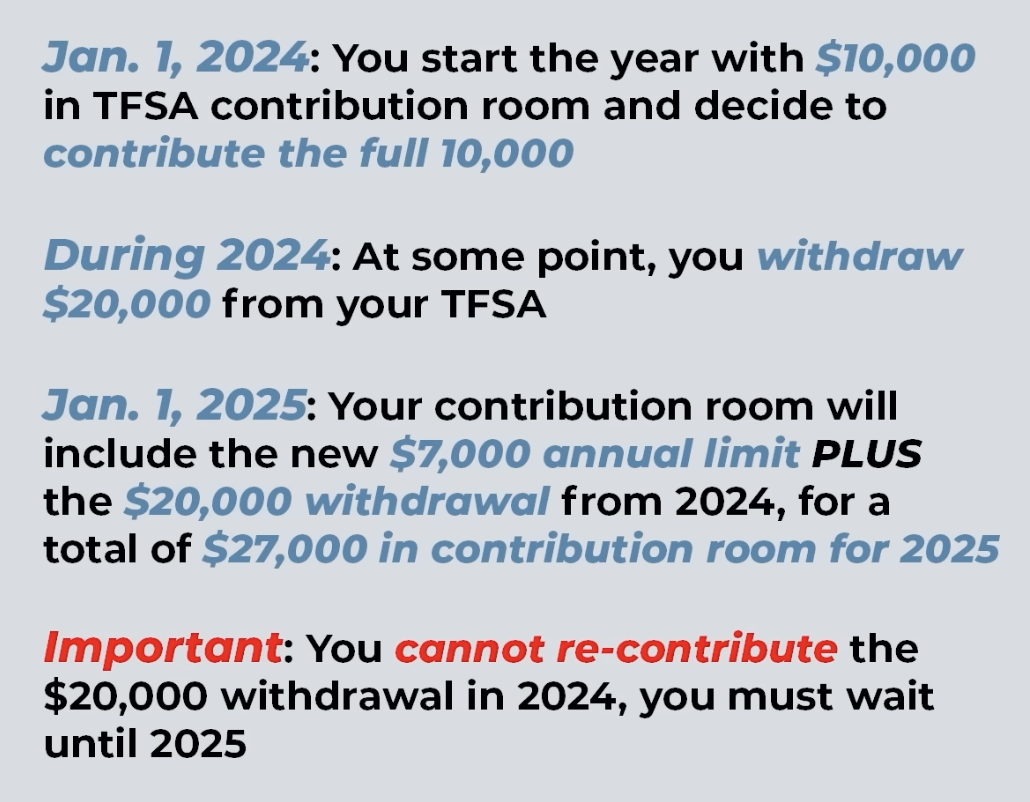

TFSA

- Use it as a lever account. If you need some extra money, pull it from your TFSA account.

- Over contributing to your TFSA are subject to a 1% penalty tax per month charged on the excess amount.

Withdrawal Example

Moving Abroad

- You can keep your TFSA

- As a non-resident, you won't accumulate new contribution room and you won't be able to contribute to your TFSA

Successor Beneficiary

- A successor beneficiary can only be a spouse or common-law partner.

- As a successor beneficiary, your spouse or common-law partner can take over your TFSA after you pass away.

Cash Wedge

- Have money you will take out in the year should be in safe investments.

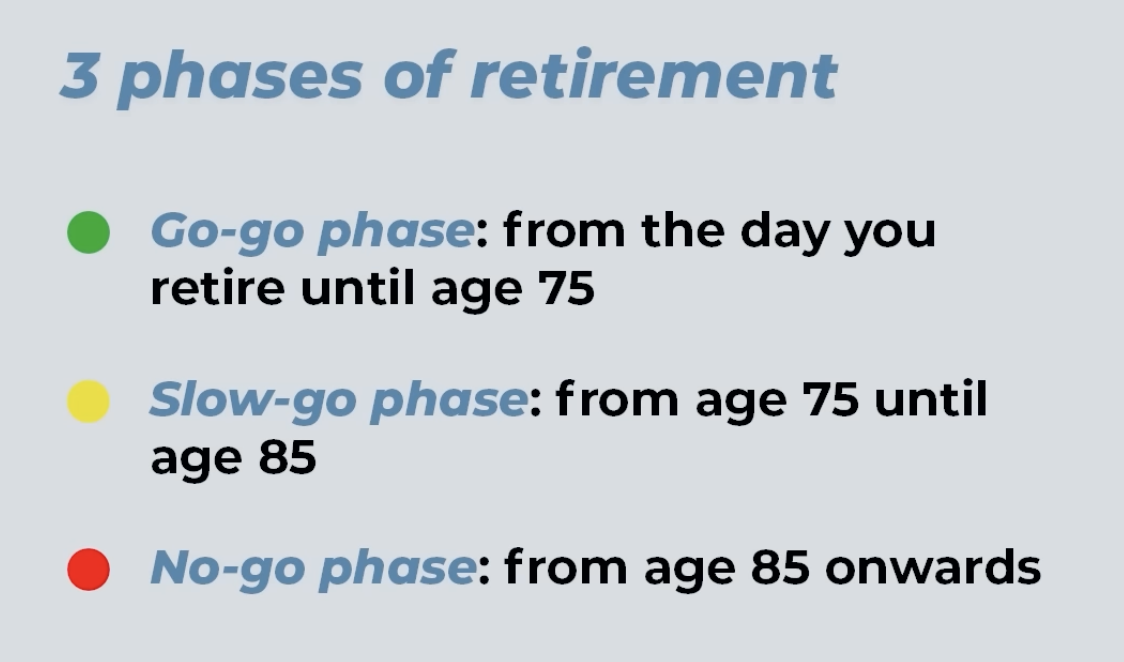

Laddered Income Strategy

You can spend more in your early stages of retirement.

Retirement Traps

- Don't assume investment returns will continue. Assume 5% return.

- Paying 2-3% for investment advice.

- Not planning for a long life.

- Listening to that "investment expert"!

- Holding on to money for too long! Don't hoard your money. See "Laddered Income Strategy".

- Getting divorced.

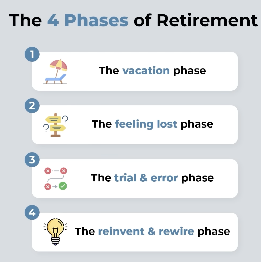

Psychological Phases of Retirement

The four phases website: https://thefourphases.com/

Retirement Regrets

- Did not spend enough money early. Could have enjoyed their money more when they were younger.

- Wished you had retired earlier.

- Wished you had travelled more.

- Wished you had found a new hobby, etc.. You should retire to something!

- Not taking care of your health.

References

| Reference | URL |

|---|---|

| 20 Years of Canadian Retirement Knowledge In 1hr 57mins | https://www.youtube.com/watch?v=r9Da-mb-zSw&t=1667s |

| Budget Tracker and Net Worth Tracker | https://www.parallelwealth.com/tools |