...

- Get ride of your debt.

- Don't enter into a car loan before entering into retirement. Pay cash for cars.

- Evaluate your insurance. Maybe you don't your life insurance, etc.

- Determine how you are going to pay for healthcare. Most Canadians pay these extra expenses out of pocket.

- Update your estate plan (will, power of attorney, document your digital assets(logins, etc).

- Determine your retirement age. (Will need to line up with your retirement plan!)

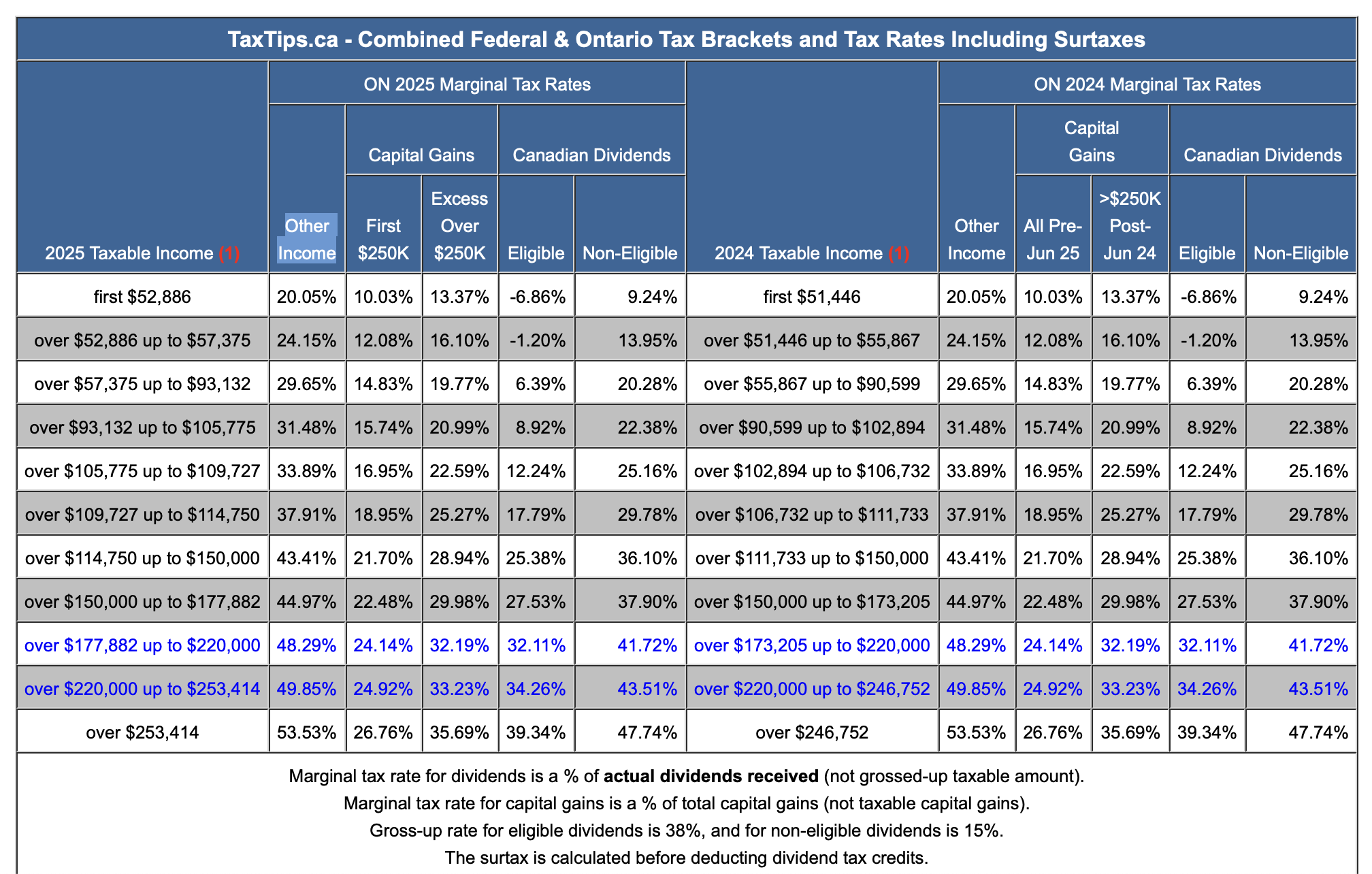

Tax Rates

https://www.taxtips.ca/taxrates/on.htm

In Ontario, the portion of your income that is not taxed comes from the basic personal amount (BPA), which applies at both the federal and provincial levels.

For 2025, the basic personal amounts are:

- Federal BPA: $15,000 (gradually reduced for incomes over $173,205)

- Ontario BPA: $11,865

This means that the first $15,000 of your income is not subject to federal tax, and the first $11,865 is not subject to Ontario provincial tax.

If you made $50k, you would pay tax on 50k-15k=35K at a rate of 20% = 7k

Retirement Budget

Figure out how much you need monthly once you retired.

...

- Have money you will take out in the year could should be in safe investments.

Laddered Income Strategy

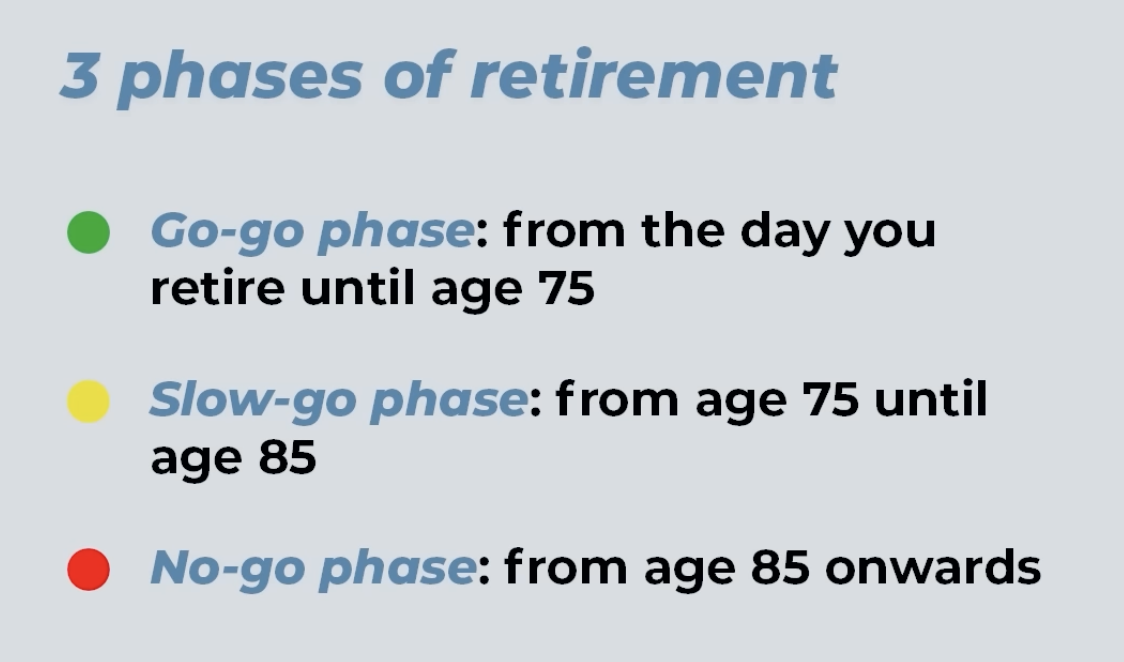

You can spend more in your early stages of retirement.

Retirement Traps

- Don't assume investment returns will continue. Assume 5% return.

- Paying 2-3% for investment advice.

- Not planning for a long life.

- Listening to that "investment expert"!

- Holding on to money for too long! Don't hoard your money. See "Laddered Income Strategy".

- Getting divorced.

Psychological Phases of Retirement

The four phases website: https://thefourphases.com/

Retirement Regrets

- Did not spend enough money early. Could have enjoyed their money more when they were younger.

- Wished you had retired earlier.

- Wished you had travelled more.

- Wished you had found a new hobby, etc.. You should retire to something!

- Not taking care of your health.

References

| Reference | URL |

|---|---|

| 20 Years of Canadian Retirement Knowledge In 1hr 57mins | https://www.youtube.com/watch?v=r9Da-mb-zSw&t=1667s |

| Budget Tracker and Net Worth Tracker | https://www.parallelwealth.com/tools |

...